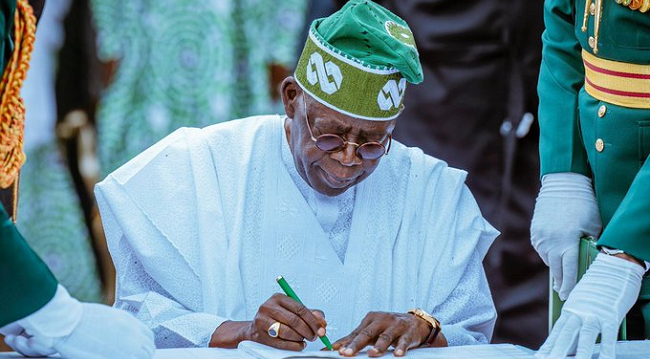

The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) has expressed its appreciation to President Bola Ahmed Tinubu for the recently enacted tax reform laws aimed at easing the financial burden on Micro, Small, and Medium Enterprises (MSMEs) across the nation. This commendation reflects a significant step towards fostering a more conducive environment for the growth and sustainability of MSMEs, which are crucial to Nigeria’s economy.

A Boost for MSMEs

SMEDAN’s Director-General, Charles Odii, highlighted that the new tax policies are timely and necessary for enhancing the operational capabilities of MSMEs. These businesses represent a substantial portion of Nigeria’s economic landscape, contributing significantly to job creation and GDP. However, many of these enterprises have struggled with the weight of excessive tax obligations that hinder their growth potential.

The recently approved tax reforms are designed to simplify tax compliance, reduce tax rates for small businesses, and offer incentives that encourage investment and expansion. Odii noted that these measures will not only relieve financial pressure on MSMEs but also stimulate innovation and competitiveness within the sector.

“By lowering the tax burden on MSMEs, the government is paving the way for increased investment, which is essential for economic recovery and growth,” Odii stated. He emphasized that a thriving MSME sector will lead to job creation and enhance the overall economic stability of Nigeria.

Collaboration for Sustainable Growth

In addition to the tax reforms, SMEDAN is optimistic about the potential for further collaboration between the agency and the federal government to support MSMEs. Odii called for the establishment of more initiatives aimed at providing technical assistance, access to finance, and capacity-building programs that will empower entrepreneurs.

The agency plans to work closely with relevant government ministries to ensure that the implementation of these tax reforms translates into tangible benefits for MSMEs. This collaboration will involve outreach programs to educate business owners about the new tax regulations, helping them navigate the changes effectively.

Furthermore, Fasanya urged the government to continue exploring additional avenues for supporting MSMEs, such as improving infrastructure, enhancing access to credit, and creating a more favorable regulatory environment. He believes that these efforts will significantly boost the resilience of small businesses, enabling them to withstand economic challenges.

In conclusion, SMEDAN’s commendation of President Bola Ahmed Tinubu for the new tax reform laws underscores a critical moment for Nigeria’s MSME sector. By reducing the tax burden and fostering a supportive ecosystem, the government is taking decisive steps to promote entrepreneurship and economic growth. As these reforms take effect, the hope is that MSMEs will flourish, contributing to a more prosperous future for Nigeria as a whole.