The Bank of Industry (BOI), under the leadership of Olasupo Olusi, is playing a crucial role in financing Nigeria’s future. As an enabler, BOI acts where markets fall short by providing concessionary financing to industries that need it the most. This approach is vital for fostering inclusive growth across various sectors of the economy.

BOI’s Role in Economic Development

BOI’s commitment to inclusive growth is evident in its strategic focus on supporting small and medium-sized enterprises (SMEs) and underserved sectors. These industries often struggle to access the necessary capital for expansion and innovation. By providing affordable financing options, BOI empowers these businesses to scale operations, create jobs, and drive economic development.

Under Olusi’s leadership, BOI has implemented various programs aimed at enhancing financial accessibility for entrepreneurs. The bank offers loans with flexible repayment terms and lower interest rates, making it easier for SMEs to thrive. This support is particularly essential in Nigeria, where many small businesses face significant barriers to financing.

Additionally, BOI has developed sector-specific initiatives that target key areas such as agriculture, manufacturing, and technology. By aligning its financing with national priorities, the bank ensures that its resources are directed toward industries that can contribute significantly to economic growth and job creation.

Addressing Market Gaps and Challenges

One of the core missions of BOI is to address the market gaps that hinder economic progress. Many sectors in Nigeria face challenges such as inadequate infrastructure, limited access to technology, and high operational costs. BOI’s financing solutions are designed to mitigate these challenges, enabling businesses to invest in necessary upgrades and innovations.

For instance, in the agricultural sector, BOI’s financing helps farmers access modern equipment and technology that boost productivity. In manufacturing, the bank supports investments in modern production facilities that enhance efficiency and competitiveness. These initiatives not only improve the viability of individual businesses but also contribute to the overall resilience of the Nigerian economy.

Moreover, BOI places a strong emphasis on sustainability and environmental responsibility. The bank encourages financing for projects that promote renewable energy and sustainable practices. This commitment aligns with global efforts to combat climate change and promotes long-term economic stability in Nigeria.

Conclusion: A Vision for the Future

In conclusion, the Bank of Industry (BOI), under Olasupo Olusi, is pivotal in financing Nigeria’s future and driving inclusive growth. By focusing on concessionary financing for underserved sectors, BOI empowers businesses to overcome challenges and thrive in a competitive landscape.

As Nigeria seeks to achieve sustainable development, the role of BOI becomes increasingly vital. Through its initiatives, the bank not only supports economic growth but also fosters an environment where all Nigerians can participate and benefit from the nation’s progress.

FAQ Section

What is the role of BOI in Nigeria?

The Bank of Industry (BOI) provides financing and support to small and medium-sized enterprises (SMEs) and other underserved sectors to promote economic growth.

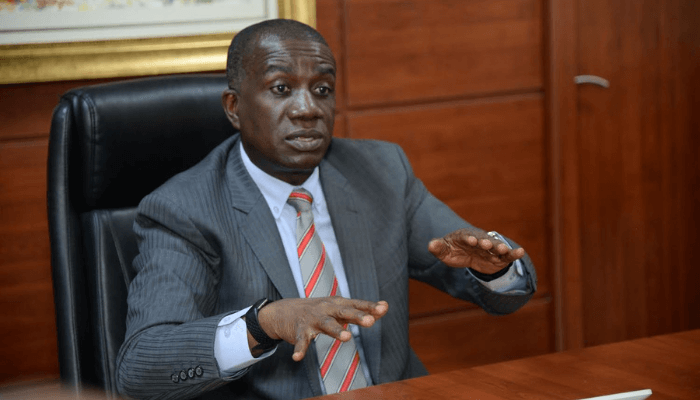

Who leads the Bank of Industry?

Olasupo Olusi is the current leader of the Bank of Industry, guiding its strategic initiatives and programs.

How does BOI support small businesses?

BOI offers concessionary financing, flexible repayment terms, and lower interest rates to help small businesses access the capital they need for growth.

Why is inclusive growth important for Nigeria?

Inclusive growth ensures that all segments of society benefit from economic development, reducing poverty and promoting social stability.