The Tinubu administration has officially requested repayment of loans given to students through the Nigerian Education Loan Fund (NELFUND). This move comes less than two years after the government disbursed these loans to support Nigerian students in their pursuit of higher education.

Understanding the Nigerian Education Loan Fund

The NELFUND was established to provide financial assistance to students who lack the resources to fund their education. This initiative aimed to empower students and increase access to quality education, reflecting the government’s commitment to fostering a knowledgeable and skilled workforce.

The loans were intended to be user-friendly, with a focus on supporting students from low-income backgrounds. By easing the financial burden, the government sought to ensure that more students could graduate without overwhelming debt or prolonged financial struggles.

However, the recent call for repayment has raised questions among former beneficiaries. Many students who received these loans were led to believe that repayment would not commence until after they graduated and secured employment. The government’s current stance has left some feeling uncertain about their financial futures.

Implications of Loan Repayment for Students

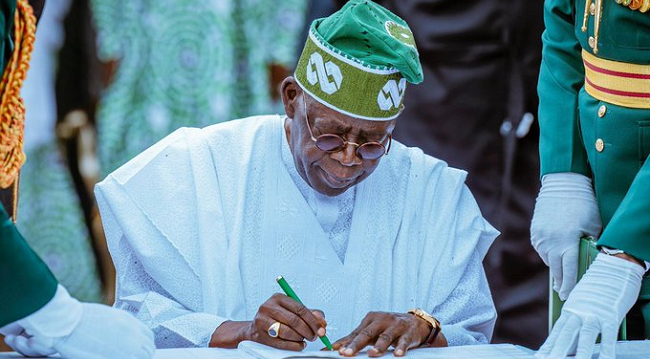

This repayment request poses challenges for many students. For those who have recently graduated and are still seeking employment, the pressure to repay the loan can add to their financial anxiety. “We must seek a balance between supporting our youth and ensuring the sustainability of educational funding programs,” Tinubu stated.

Students who are unemployed or underemployed may find it particularly difficult to manage loan repayments. They may feel as though their educational sacrifices have resulted in added stress rather than the anticipated opportunities for a better future.

The government must also consider strategies that make repayment more manageable. Offering flexible payment plans or grace periods could alleviate some of the pressures on recent graduates. A clear and transparent communication strategy regarding repayment terms will be crucial for maintaining trust between the administration and the student body.

Conclusion: Navigating the Future of Student Loans

In conclusion, the Tinubu government’s request for repayment of NELFUND loans highlights the complexities of student financial assistance in Nigeria. While the intention behind the fund was to facilitate access to education, the timing of repayment requests poses significant challenges for many students.

As former beneficiaries navigate this new reality, it is essential for the government to adopt policies that support their financial well-being. By focusing on flexible repayment options and clear communication, the administration can foster a more positive experience for graduates.

Ensuring that education remains accessible and sustainable is vital for Nigeria’s future. As the nation works to empower its youth, the balance between financial responsibility and support must be carefully managed. Through thoughtful engagement and policy adjustments, the government can help students transition successfully into their professional lives while honoring their financial commitments.