The Nigerian National Petroleum Company Limited (NNPC Ltd) is currently facing significant financial challenges as debt owed by its subsidiaries has surged to an alarming ₦30.3 trillion. Under the new leadership of Bayo Ojulari, the company aims to navigate these mounting pressures and restore fiscal health. The keyphrase for this article is “NNPC Debt Reaches ₦30.3 Trillion Crisis.”

An Overview of the Financial Situation

The rise in debt indicates persistent issues within NNPC’s operational framework. Factors contributing to this growing financial pressure include declining oil production, increased operational costs, and management inefficiencies. Such conditions have exacerbated the existing debt burden, rendering it unsustainable for the organization.

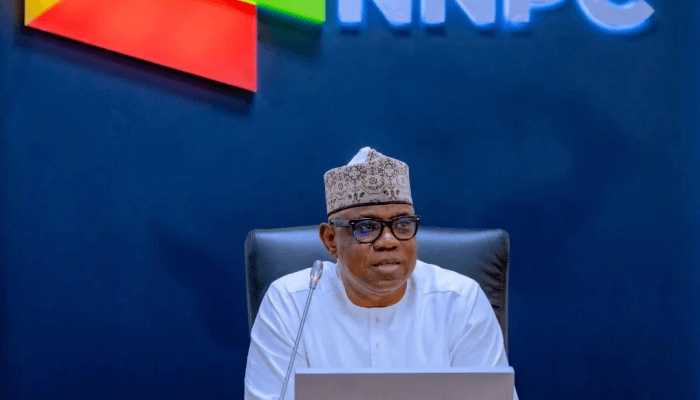

While the debt figure is concerning, it is essential to approach this situation with a focus on solutions. Bayo Ojulari’s recent appointment as CEO brings renewed optimism as he steps into the role amidst these challenges. Known for his proactive leadership style and industry expertise, Ojulari is poised to implement changes that can effectively address NNPC’s financial strains.

In facing these challenges, Ojulari’s leadership is characterized by transparency and a commitment to reform. His approach is essential for restoring confidence both within the company and among external stakeholders.

The Role of Bayo Ojulari in the Crisis

Bayo Ojulari’s leadership is vital at this point in NNPC’s history. His understanding of the oil industry and financial management positions him well to tackle the issues at hand. Under his guidance, NNPC is exploring innovative strategies to deal with the burgeoning debt.

- Debt Restructuring Initiatives: Ojulari plans to engage with financial institutions to negotiate more favorable terms for existing debts. This is a critical first step toward providing NNPC with the liquidity it needs to stabilize its operations.

- Operational Efficiency Improvements: By focusing on cost management and streamlining operations, Ojulari aims to reduce unnecessary expenditures. Implementing efficiency measures will help NNPC redirect funds toward critical projects.

- Investment in Technology: Enhancing technology use across operations is another focus area for Ojulari. Advances in technology can significantly reduce operational costs and increase productivity, contributing to the financial recovery.

- Stakeholder Collaboration: Engaging stakeholders and promoting transparency is integral to Ojulari’s strategy. By keeping investors and the public informed, he fosters trust and accountability, which are valuable during this turbulent time.

The Path Ahead for NNPC

As the debt crisis unfolds, NNPC’s recovery will rely heavily on Bayo Ojulari’s strategic vision. His leadership can bring about necessary reforms that focus on building a more sustainable organization.

The collective effort of NNPC under Ojulari must prioritize not just debt management but also fostering a culture of accountability and efficiency. The oil and gas industry is crucial for Nigeria’s economy, making the stabilization of NNPC a matter of national interest.

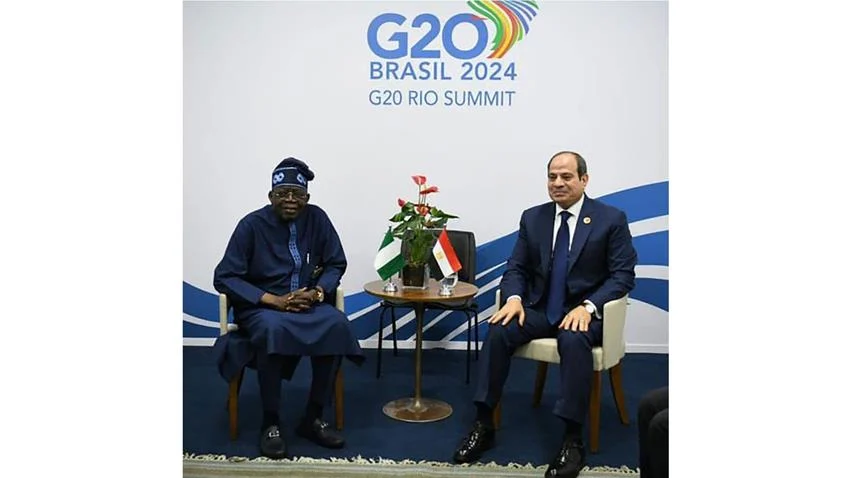

The support of the government and relevant stakeholders will be critical. Collaboration across the board — from financial institutions to political leaders — can create an enabling environment for recovery and growth.

Conclusion: A Vision for Financial Recovery

In conclusion, NNPC’s debt at ₦30.3 trillion reflects significant financial challenges but also presents opportunities for reform and improvement. Under the leadership of Bayo Ojulari, the company is poised to face these challenges head-on.

Ojulari’s proactive approach, with a focus on transparency and operational efficiency, is essential in navigating this financial crisis. By implementing strategic measures and engaging stakeholders, the NNPC can recover from this debt, ultimately ensuring its pivotal role in the Nigerian economy.

As NNPC embarks on this journey of recovery, all eyes will be on Bayo Ojulari and his team to restore confidence and drive growth in the oil and gas sector. The path ahead may be challenging, but with determined leadership, a more sustainable future is possible for one of Nigeria’s most critical institutions.