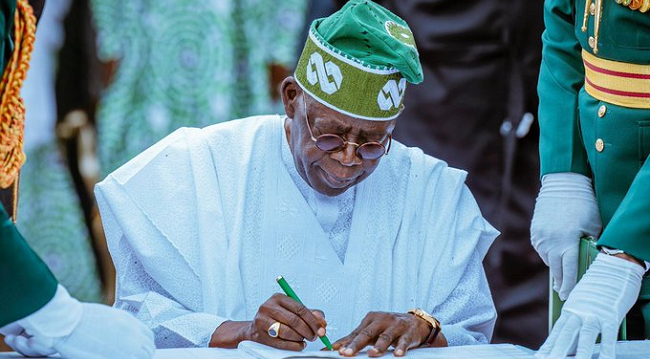

In a significant move aimed at revitalizing Nigeria’s economy, President Bola Ahmed Tinubu has officially signed into law several tax reform bills that will transform the nation’s fiscal landscape. This decision supports the administration’s broader strategy to enhance revenue generation, stimulate economic growth, and improve the ease of doing business in Nigeria.

Comprehensive Tax Overhaul

The new tax reform bills introduce a comprehensive overhaul of Nigeria’s tax system. They simplify tax compliance and broaden the tax base. For instance, the reforms reduce corporate tax rates for small and medium-sized enterprises (SMEs). This change encourages entrepreneurship and fosters innovation, providing relief to businesses struggling in the current economic climate.

Moreover, the reforms enhance tax collection efficiency by adopting modern technology and data analytics. These advancements will empower the Federal Inland Revenue Service (FIRS) to track and collect taxes better. As a result, Nigeria can reduce its dependency on oil revenues. Additionally, the reforms emphasize increased transparency and accountability in tax administration, which is vital for rebuilding public trust in the system.

President Tinubu emphasized that these reforms are crucial for diversifying Nigeria’s economy. By ensuring sustainable growth, the new tax laws aim to attract foreign investment and create a favorable environment for local businesses. Ultimately, this approach leads to job creation and economic stability.

Implications for Nigerians and Businesses

These tax reforms have far-reaching implications. For individuals and businesses, they will create a more equitable tax system that distributes the tax burden more evenly. By broadening the tax base, the government aims to reduce reliance on a small percentage of taxpayers, a significant issue in Nigeria’s tax collection efforts.

Furthermore, the reforms include tax incentives that promote investments in key sectors such as agriculture, technology, and renewable energy. These incentives stimulate growth in areas that can significantly contribute to the economy.

As the government rolls out these reforms, public awareness campaigns will play a crucial role. Educating citizens and businesses about the new tax laws and their benefits is essential. President Tinubu expressed confidence that successful implementation of these reforms will lead to greater economic resilience and stability.

In conclusion, President Bola Ahmed Tinubu’s signing of the tax reform bills marks a pivotal moment in Nigeria’s economic journey. By modernizing the tax system and encouraging compliance, the administration aims to create a robust and equitable economy that benefits all Nigerians. With effective implementation and public engagement, these reforms promise a brighter economic future for the nation.