President Bola Tinubu recently met with the board of the Nigerian Exchange Group (NGX) and the Director-General of the Securities and Exchange Commission (SEC) in Brazil. During this meeting, he emphasized his commitment to protecting investors and implementing reforms that will unlock capital in Nigeria’s financial sector.

Commitment to Financial Sector Reforms

In his address, President Tinubu outlined his vision for transforming Nigeria’s financial landscape. He acknowledged the importance of a robust capital market in driving economic growth. By safeguarding investors’ interests, he believes the country can attract both local and foreign investments.

Tinubu stressed that reforms are essential to enhancing the investment climate. These reforms include streamlining regulations, improving transparency, and fostering competition within the financial sector. He emphasized that a well-regulated market is crucial for building investor confidence.

Furthermore, the President highlighted the need for innovation in financial services. He noted that technology could play a pivotal role in enhancing access to financial products and services. By leveraging fintech solutions, Nigeria can create a more inclusive financial ecosystem that benefits all citizens.

Collaboration with Key Stakeholders

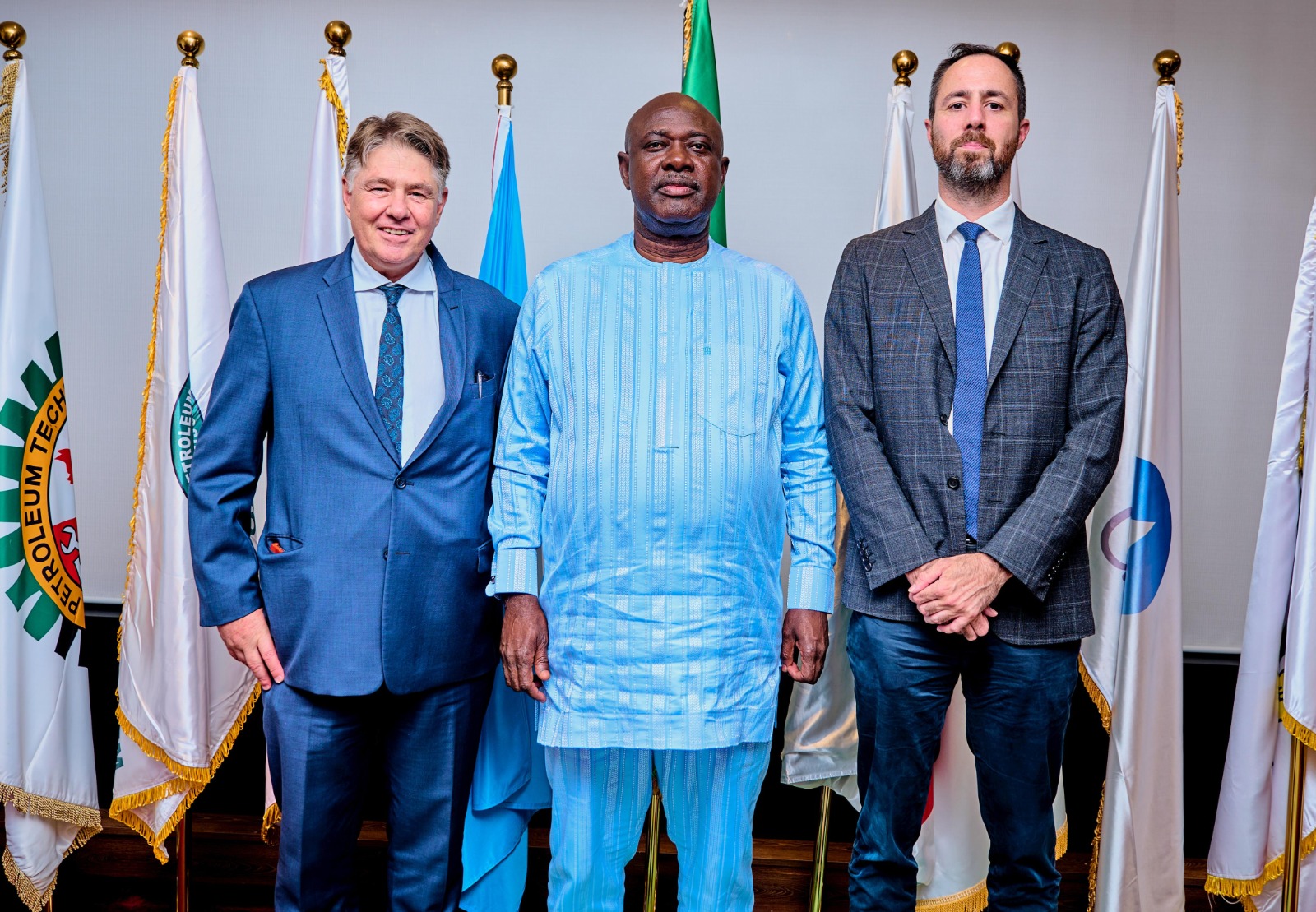

President Tinubu being present at this meeting with the NGX and SEC in Brazil underscores the importance of collaboration among key stakeholders in the financial sector. He called for ongoing dialogue to address challenges and identify opportunities for growth. This collaborative approach is vital for creating a sustainable investment environment.

The President also acknowledged the role of the NGX and SEC in promoting market integrity. He urged both institutions to continue their efforts in ensuring a level playing field for all investors. By maintaining high standards of governance, they can further enhance confidence in Nigeria’s financial markets.

In conclusion, President Bola Tinubu’s commitment to protecting investors and pursuing reforms in Nigeria’s financial sector marks a significant step toward economic stability. His proactive approach aims to unlock capital and foster innovation, ultimately driving growth in the nation’s economy. As Nigeria navigates its financial challenges, collaboration between the government, regulatory bodies, and investors will be crucial for achieving lasting success.