The Bank of Industry (BOI) has notified applicants of the Federal Government Tertiary Institution Staff Support Fund (TISSF) loan to verify their KYC (Know Your Customer) details. This announcement comes as part of the bank’s ongoing efforts to streamline the loan application process and ensure compliance with regulatory requirements.

Importance of KYC Verification

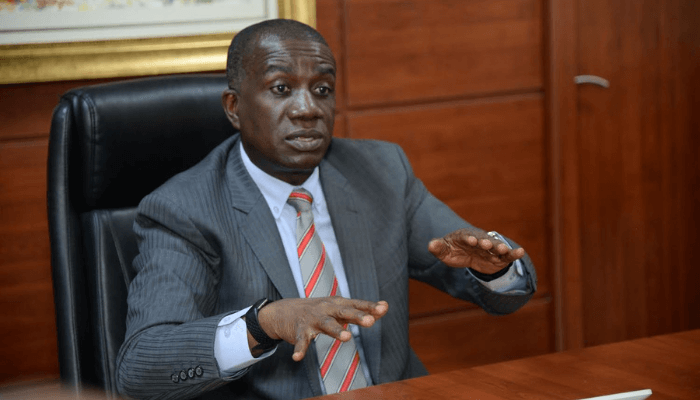

Under the leadership of Olasupo Olusi, BOI emphasizes that KYC verification is essential for maintaining the integrity of the banking system. By confirming the identity of loan applicants, the bank aims to prevent fraud and ensure that funds are disbursed to legitimate recipients. This step is crucial, especially in the context of government-sponsored loan initiatives.

The TISSF loan is designed to provide financial support to staff of tertiary institutions, helping them manage personal and professional expenses. However, to access these funds, applicants must ensure that their KYC details are accurate and up-to-date. The bank has urged applicants to review their information, including identification documents and contact details, to avoid delays in processing their loans.

Olasupo Olusi stated that the BOI is committed to facilitating access to financial resources for those in the education sector. He reiterated the bank’s dedication to supporting the growth of the tertiary education system in Nigeria through various funding initiatives. The KYC verification process is a vital part of ensuring that these efforts are successful and transparent.

Steps for KYC Verification

To assist applicants, BOI has outlined several steps for KYC verification. First, applicants should log into their BOI accounts and navigate to the KYC section. They will need to provide relevant identification documents, such as national IDs, passports, or driver’s licenses. Additionally, applicants should ensure that their contact information, including phone numbers and email addresses, is current.

The bank also encourages applicants to reach out to their customer service helplines if they encounter any issues during the verification process. BOI aims to make this process as user-friendly as possible, recognizing that many applicants may not be familiar with KYC requirements.

Furthermore, the bank has assured applicants that their data will be handled securely and in compliance with privacy regulations. This commitment to data protection is essential for building trust among clients and stakeholders.

In conclusion, the Bank of Industry’s notification regarding KYC verification for TISSF loan applicants highlights the importance of compliance in accessing financial support. Under Olasupo Olusi’s leadership, the bank remains focused on facilitating access to funds while ensuring the security and integrity of its processes. By encouraging applicants to verify their KYC details, BOI aims to enhance the efficiency of the loan application process and better serve the educational sector in Nigeria.