Nigeria’s economic landscape has been turbulent in recent years, marked by rising debt levels and significant financial challenges. However, recent developments suggest that the leadership of Central Bank of Nigeria (CBN) Governor Yemi Cardoso and President Bola Ahmed Tinubu may be averting a potential debt crisis. Through a series of strategic policy initiatives and a commitment to fiscal discipline, these leaders are working to stabilize the economy and steer Nigeria towards a more sustainable financial future.

Inherited Economic Challenges

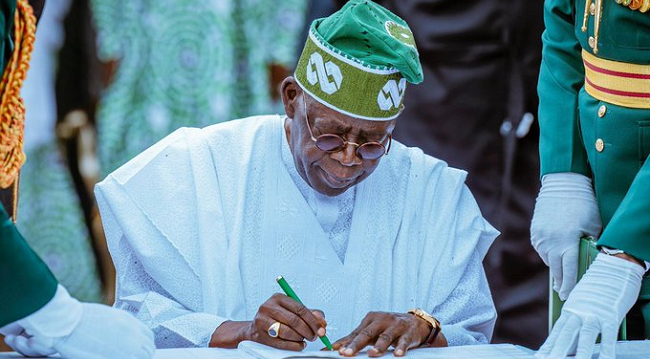

Upon assuming office, President Tinubu’s administration inherited a challenging economic situation. Public debt had soared, with a significant portion of government revenue being allocated to debt servicing. The previous administration, under Godwin Emefiele, was described as weak and inefficient, with the CBN entangled in political issues. The foreign exchange market was chaotic, and the Naira faced persistent devaluation pressures.

Strategic Policy Interventions

To address these challenges, President Tinubu and Governor Cardoso have implemented several key policy measures:

- Ending Fuel Subsidies: President Tinubu removed the costly fuel subsidy, redirecting funds towards critical infrastructure, healthcare, and education projects. This decision, though initially unpopular, has freed up substantial resources for development.

- Exchange Rate Unification: The CBN unified multiple exchange rate windows to eliminate arbitrage opportunities and restore investor confidence. This reform has led to increased remittances and efforts to clear the FX backlog.

- Monetary Policy Tightening: The CBN has adopted an aggressive monetary tightening stance, raising the Monetary Policy Rate (MPR) to curb inflation and reduce excess liquidity.

- Fiscal Responsibility: The administration has emphasized fiscal discipline, aiming to reduce the debt service ratio and create fiscal space for investments in key sectors.

- Attracting Investments: Tinubu’s policies have attracted significant foreign direct investment, with over $30 billion entering the country in the last fifteen months.

Positive Economic Indicators

These policy interventions are beginning to yield positive results:

- Reduced Debt Service Burden: Nigeria has reduced its debt servicing burden from 96% of 2023 revenue to 67%, creating fiscal space for essential investments.

- Increased Foreign Reserves: Net foreign reserves have increased, providing a buffer against external shocks. Gross reserves have also risen.

- Improved Investor Confidence: International credit rating agencies like Fitch Ratings have recognized Nigeria’s progress in restoring economic fundamentals, signaling increased investor confidence.

- Cleared IMF Debt: Nigeria has exited the list of countries indebted to the International Monetary Fund (IMF), having cleared its $1.61 billion debt.

- Diaspora Remittances Increase: Remittances through International Money Transfer Operators have increased significantly.

- Inflation Control: CBN policies have prevented inflation from surging to potentially higher levels.

Challenges and Criticisms

Despite these positive developments, challenges remain. Nigeria’s public debt continues to rise, and the government is seeking further loans to fund development projects. Critics, like former Vice President Atiku Abubakar, have warned against excessive borrowing, suggesting it could lead to a debt crisis. Additionally, the removal of fuel subsidies and exchange rate reforms have caused hardship for many Nigerians, with rising energy prices and food inflation.

The Path Forward

To ensure long-term economic stability, President Tinubu and Governor Cardoso must:

- Maintain Fiscal Discipline: Continue to prioritize fiscal responsibility and reduce reliance on borrowing.

- Promote Transparency: Ensure transparency in government spending and debt management.

- Diversify the Economy: Focus on diversifying the economy away from oil dependence.

- Address Inflation: Implement measures to control inflation and ease the burden on citizens.

- Encourage Local Production: Prioritize local goods and services to stimulate domestic industries.

While challenges persist, the strategic policy interventions of President Tinubu and Governor Cardoso offer a glimmer of hope that Nigeria can navigate its debt challenges and build a more resilient and prosperous economy. Their commitment to fiscal discipline, transparency, and attracting investment is crucial for steering Nigeria away from potential debt submersion and towards sustainable growth. domestic industries.

While challenges persist, the strategic policy interventions of President Tinubu and Governor Cardoso offer a glimmer of hope that Nigeria can navigate its debt challenges and build a more resilient and prosperous economy. Their commitment to fiscal discipline, transparency, and attracting investment is crucial for steering Nigeria away from potential debt submersion and towards sustainable growth.