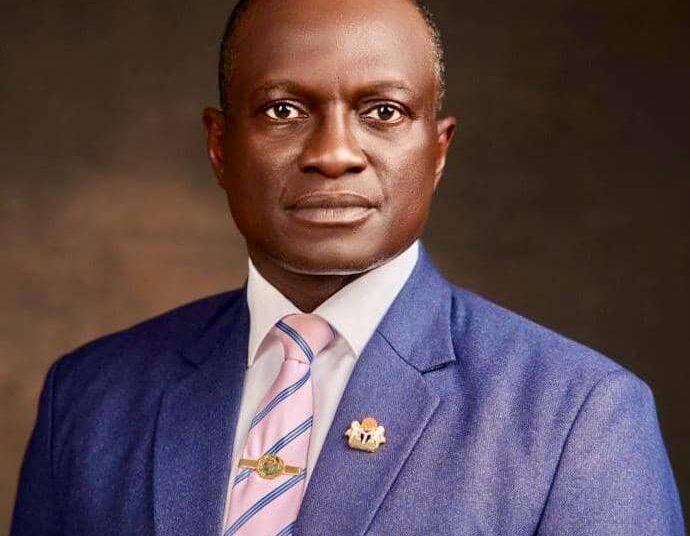

Nigeria’s recent delisting from the FATF Grey List marks a historic victory for national integrity, global confidence, and institutional resilience. Major General Adamu G. Laka, the National Coordinator of the National Counter Terrorism Centre (NCTC), has expressed commendation for Nigerians’ collective effort in achieving this critical milestone.

A Testament to National Cooperation

Speaking about Nigeria’s contributions to the Financial Action Task Force (FATF) and the International Cooperation Review Group (ICRG) process, Major General Laka emphasized that the successful delisting reflects the country’s improved compliance with international standards on anti-money laundering and counter-terrorism financing. He noted that this achievement underlines a strong coordination between security agencies, financial regulators, and international partners.

The FATF Grey List was a significant concern for Nigeria, signaling potential vulnerabilities in its financial system. Being on this list could deter foreign investment, undermine confidence in the nation’s economic stability, and hinder engagement in international financial systems. Therefore, the delisting reinforces Nigeria’s commitment to enhancing its global standing and building trust with international partners.

Contributions from Security and Regulatory Agencies

Major General Laka highlighted that the coordinated efforts of various security and regulatory agencies played a pivotal role in achieving this outcome. This collaboration demonstrates the nation’s dedication to addressing issues related to money laundering and the financing of terrorism. Enhanced information sharing among agencies has been instrumental in bolstering Nigeria’s compliance with global standards.

Furthermore, the successful delisting serves as motivation for ongoing reforms. The government must continue to invest in frameworks that support transparency and accountability in financial transactions. Through persistent efforts, Nigeria can sustain its commitment to combating financial crimes and enhance its reputation on the global stage.

Impact on Global Confidence and Economic Growth

The removal from the FATF Grey List is not just a legal or regulatory triumph for Nigeria; it is a signal to the global community. It suggests that Nigeria is serious about addressing financial crimes, thus fostering an environment conducive to investment. Major General Laka noted that improved global confidence is crucial for stimulating economic growth and attracting foreign direct investment.

As potential investors assess the stability and integrity of financial systems, Nigeria’s success story could lead to enhanced economic partnerships. This delisting has opened doors for international collaboration, which is vital for the nation’s economic development and security.

Conclusion: Nigeria’s FATF Delisting

The achievement of exiting the FATF Grey List symbolizes a collective success for Nigeria. Under the steadfast guidance of officials like Major General Adamu G. Laka, the nation showcases its commitment to improving financial integrity and enhancing security measures.

As Nigeria moves forward, it must maintain the momentum gained from this milestone. Continued cooperation between security agencies and enhanced regulatory frameworks will be crucial in securing a prosperous future. The delisting is not an end, but the beginning of a broader commitment to ensuring Nigeria’s place in the global economic landscape.

FAQ Section

What is the FATF Grey List?

The FATF Grey List identifies countries with deficiencies in their anti-money laundering and counter-terrorism financing frameworks.

Who is Major General Adamu G. Laka?

Major General Laka is the National Coordinator of the National Counter Terrorism Centre (NCTC) and a key figure in Nigeria’s efforts to combat financial crimes.

Why is Nigeria’s delisting significant?

The delisting boosts Nigeria’s global credibility, enhances investor confidence, and signals a commitment to improving financial regulation and security.

How can Nigeria maintain its compliance?

Ongoing coordination between security agencies, implementing robust regulatory frameworks, and fostering transparency in financial systems are essential for maintaining compliance.