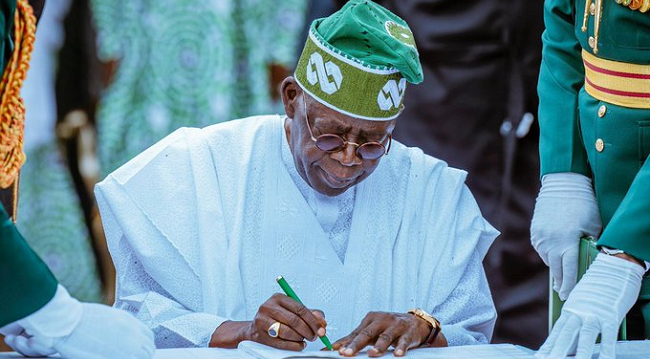

Bismark Rewane, a prominent economist and CEO of the Financial Derivatives Company Limited, recently discussed President Bola Ahmed Tinubu’s approval of a 15% import duty on petrol. Rewane argues that this decision is beneficial for Nigeria’s economy and can lead to significant positive changes.

Why the 15% Import Duty Matters

The approval of a 15% import duty on petrol represents a strategic move aimed at tackling several economic challenges. According to Rewane, this decision is crucial for several reasons.

First, the import duty encourages local refining of petrol. By making imported petrol more expensive, the government hopes to incentivize domestic refineries to increase production. Nigeria has long relied on imported petrol, which has created economic vulnerabilities. Shifting towards local production can reduce this dependency and strengthen energy security.

Second, the revenue generated from this import duty can be substantial. The government can redirect these funds toward essential public services and infrastructure development. In a country where infrastructure often lags, this additional funding can improve roads, healthcare, and education.

Economic Benefits of the Import Duty

Rewane emphasizes that the economic impacts of the import duty are wide-ranging. Here are some key benefits:

- Boosting Local Investment: The import duty can stimulate local investment in the oil sector. Investors may be more willing to support domestic refineries, knowing there is a market for locally produced petrol.

- Creating Jobs: By boosting local production, the policy can generate jobs in the refining sector. This is particularly important for a country with high unemployment rates, as it offers opportunities for skilled and unskilled workers.

- Reducing Fuel Subsidies: The import duty could help decrease the need for fuel subsidies. By stabilizing fuel prices through increased local production, the government can lessen its financial burdens associated with subsidizing petrol costs.

- Strengthening the Naira: Reducing reliance on imported petrol helps stabilize the Naira. As local production increases, the need for foreign currency to purchase imported petrol decreases. This can lead to a stronger national currency over time.

- Environmental Advantages: Encouraging local production may also bring environmental benefits. Transporting petrol over long distances has a significant carbon footprint. By refining locally, Nigeria can reduce transport emissions and promote sustainable practices.

Conclusion: A Step Forward for Nigeria

In conclusion, President Bola Ahmed Tinubu’s introduction of a 15% import duty on petrol is a strategic decision that could yield numerous benefits for Nigeria. As articulated by Bismark Rewane, this policy may promote local production, create jobs, and generate revenue for essential services.

While challenges remain, the potential for positive economic change is significant. This policy represents a step toward reducing Nigeria’s dependency on imports and fostering a more resilient economy.

FAQ Section

What is the 15% import duty on petrol?

The 15% import duty on petrol is a tax approved by President Bola Ahmed Tinubu to reduce reliance on imported fuel and encourage local production.

How will this policy benefit Nigeria?

The policy can lead to increased local refining, job creation, and revenue generation for public services while reducing dependency on imported petrol.

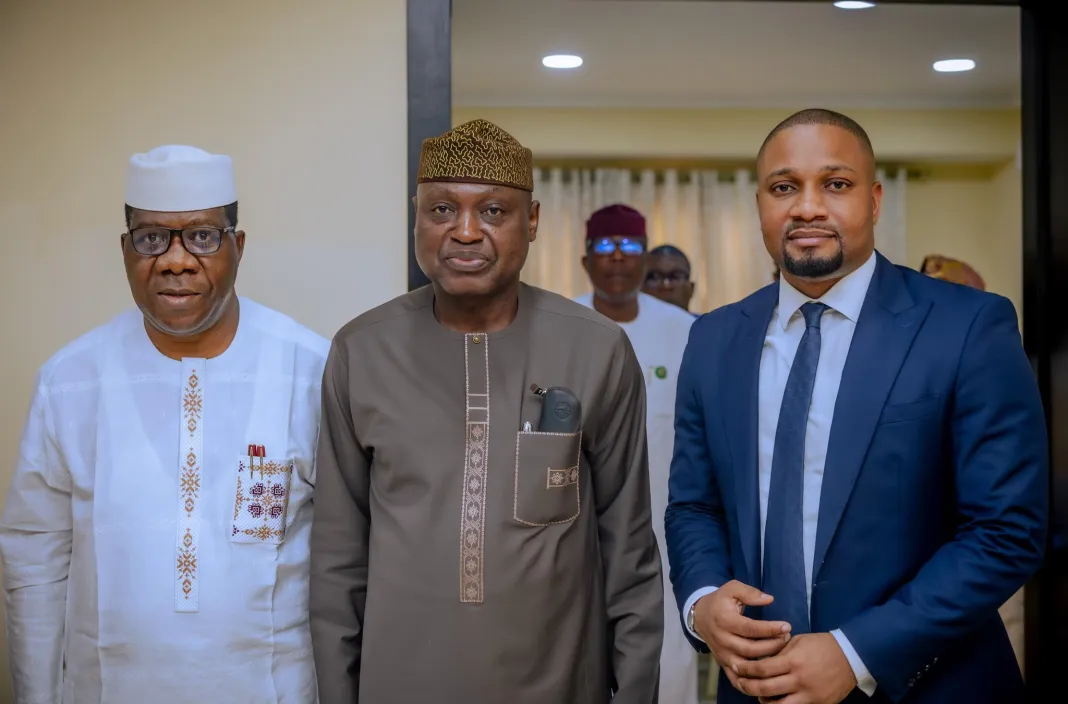

Who is Bismark Rewane?

Bismark Rewane is a prominent economist and the CEO of the Financial Derivatives Company Limited, known for his insights on Nigeria’s economic policies.

What are the potential long-term effects of the import duty?

Long-term effects may include a stronger Naira, reduced fuel subsidies, and improved infrastructure development funded by the revenue generated from the import duty.