The Development Bank of Nigeria (DBN), in collaboration with the Bank of Industry (BOI), has unveiled a new development finance framework aimed at accelerating job creation and promoting sustainable growth across Nigeria. This initiative, supported by financial leaders including Dr. Tony Okpanachi, marks a significant step towards enhancing access to finance for businesses and entrepreneurs nationwide.

Empowering MSMEs for Economic Growth

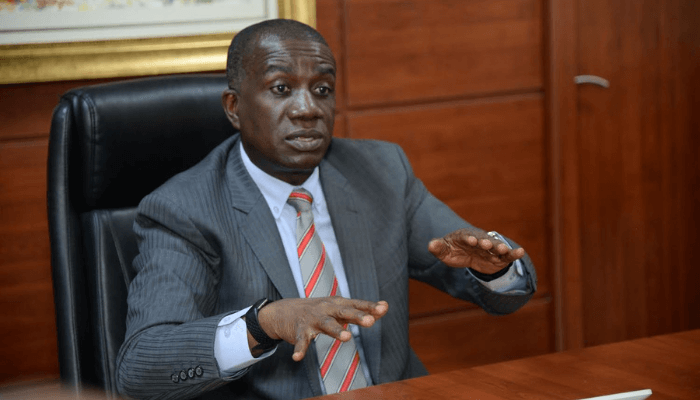

Dr. Tony Okpanachi, the Managing Director of DBN, is a staunch advocate for inclusive economic development. He emphasized that the new framework will unlock fresh funding channels specifically for micro, small, and medium enterprises (MSMEs). This sector is crucial for Nigeria’s economic health, as it accounts for a significant portion of employment and GDP.

The initiative aims to provide innovative financial models and targeted lending practices that empower local businesses. By enabling MSMEs to expand their operations, the framework seeks to create additional jobs and contribute meaningfully to Nigeria’s ambitious target of achieving a $1 trillion economy. Dr. Okpanachi highlighted that the success of this framework relies on collaboration between global and local financial institutions.

According to Okpanachi, bridging Nigeria’s financing gap is essential for economic stability. The integration of digital tools and flexible loan structures will ensure that more small business owners—especially those in underserved communities—can access affordable and sustainable credit. This approach not only enhances financial inclusion but also fosters entrepreneurship, driving economic growth from the grassroots level.

The Role of Digital Innovation in Financing

Dr. Okpanachi noted that digital innovation is a key component of the new finance framework. The use of technology can streamline lending processes, making it easier for MSMEs to apply for and receive funding. By leveraging digital platforms, the DBN aims to reduce the time and costs associated with traditional lending methods.

Moreover, the framework encourages financial institutions to adopt flexible loan structures that align with the unique needs of small businesses. This adaptability is critical, as many MSMEs face varying challenges that require tailored financial solutions. By addressing these needs, the initiative seeks to create a more supportive environment for entrepreneurs trying to navigate the complexities of running a business in Nigeria.

The commitment to empowering MSMEs through this new framework aligns with the broader goals of the Nigerian government and development partners. By fostering a more inclusive financial ecosystem, the DBN and BOI are taking crucial steps toward building a resilient economy that benefits all segments of society.

Conclusion: DBN and Okpanachi Launch New Finance Framework

In conclusion, the launch of the new development finance framework by the Development Bank of Nigeria (DBN) and the Bank of Industry (BOI) represents a promising initiative for enhancing access to finance for MSMEs. Under the leadership of Dr. Tony Okpanachi, this framework aims to empower local businesses, stimulate job creation, and contribute to Nigeria’s economic growth.

As the DBN continues to innovate and adapt to the needs of entrepreneurs, the potential for transformative change in Nigeria’s financial landscape becomes increasingly evident. By working collaboratively with various stakeholders, this initiative can help bridge the financing gap and support the nation’s drive towards sustainable development.

FAQ Section

What is the new finance framework about?

The new finance framework aims to accelerate job creation and promote sustainable growth by enhancing access to finance for micro, small, and medium enterprises (MSMEs).

Who is Dr. Tony Okpanachi?

Dr. Tony Okpanachi is the Managing Director of the Development Bank of Nigeria (DBN) and a strong advocate for inclusive economic development.

How will the framework support MSMEs?

The framework will provide innovative financial models and targeted lending to empower local businesses, enabling them to expand and create jobs.

Why is digital innovation important in this framework?

Digital innovation streamlines lending processes, making it easier for MSMEs to access affordable credit and tailored financial solutions.